UWPC is committed to helping families reclaim the dollars that increase their families financial well being. 211 is also able to schedule in-person appointments with trained tax payers. Call or email 211@uwpc.org.

File online at MyFreeTaxes.com - brought to you by United Way Worldwide

Working Families tax credit (if filing online, 211 support) - English

Working Families tax credit (if filing online, 211 support) - Spanish

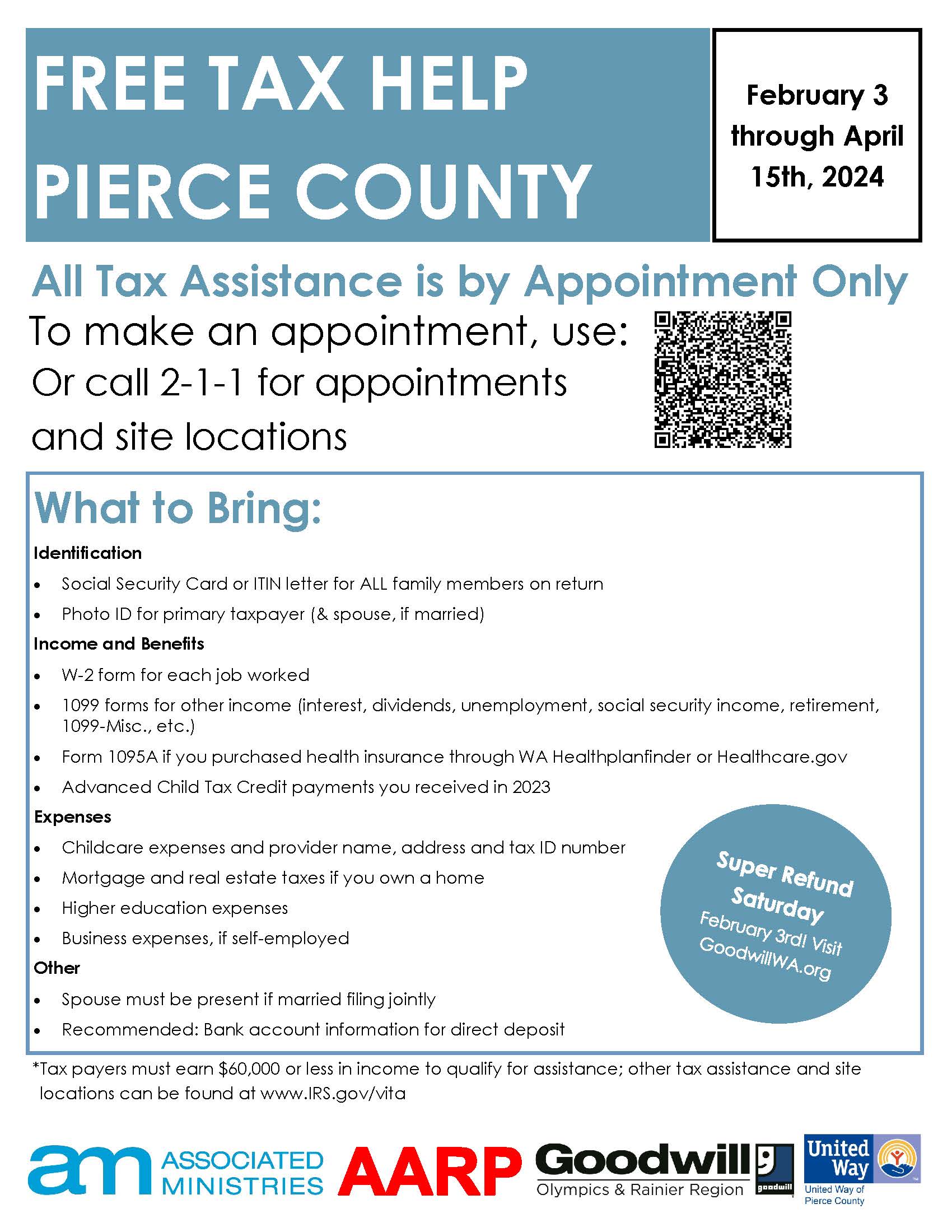

VITA (Volunteer Income Tax Assistance) - see below

Download and Printable PDF of Tax Help